21+ 1 mortgage calculator

Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years. The average mortgage interest rate is around 55 for a 30-year fixed mortgage.

20 Gorgeous Examples Of Redwood Decks Redwood Decking Building A Deck Deck Design

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. Mortgage Calculator Estimate The calculator below will give you an idea of the following. Plan out your property investment portfolio.

In this scenario you take out a primary mortgage for 80 percent of the selling price then take out a second mortgage loan for 20 percent of the selling price. The most common ARM loans are 51. What mortgage term would you like.

Account for interest rates and break down payments in an easy to use amortization schedule. HomeEquity Bank acquired by Ontario Teachers. Mortgage Calculator With PMI is a mortgage amortization calculator that has an option to include Private Mortgage Insurance or PMI.

Getting The Most Out of Using This Calculator. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. See how your monthly payment changes by making updates to.

Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Use our free mortgage calculator to estimate your monthly mortgage payments. These are also the basic components of a mortgage.

7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33. Mortgages are how most people are able to own homes in the US. Advanced Extra Mortgage Payments Calculator.

The first number format refers to the initial period of time that a hybrid mortgage is fixed whereas the second number refers to how frequently the rate can subsequently adjust after the fixed period. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Free Reverse Mortgage Calculator.

Sometimes these loans are called 80-10-10 loans. Or 2 Monthly Mortgage. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or. Bank of America lauches zero-down mortgage for Black Latino borrowers To qualify applicants must be looking to purchase a house in Charlotte Dallas Detroit Los Angeles and Miami. See how your monthly payment changes by making updates to.

A mortgage usually includes the following key components. Havent found a property to purchase yet. British Columbia Kelowna 1591 Langley 1265.

The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. Thus the Mortgage Calculator is the place to determine whether a particular property is affordable based on the Members affordable mortgage payment. Youll leave this 1-hour session with a written down plan.

Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Or for loan qualification purposes on a mortgage refinance or a credit line against your home equity for up to four lender Loan-to-Value LTV ratios. The most common ARM loans are 51.

Pick properties that fit with your plan. Speak to a real person now. Enter some basic information to find out how much money you qualify for with the CHIP Reverse Mortgage.

555 only home equity loan. When you increase the principal it makes the interest cost higher. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

3 Up to 3 Cashback is available to First Time Buyers Movers and Switchers who draw down a new mortgage by 31 December 2023. Rates are influenced by the economy your credit score and loan type. The first step in the programme is to co-create a plan using our MyWealth Plan software.

The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. 1 Maximum Purchase Price based on your desired monthly mortgage payment. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the.

Interest also increases with a higher rate and. Mortgage Loan 1 Loan 2. On Friday September 02 2022 the current average 30-year fixed-mortgage rate is 608 increasing 20 basis points over the last seven days.

Some second mortgage loans are only 10 percent of the selling price requiring you to come up with the other 10 percent as a down payment. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. 2 Cashback on draw down of a new mortgage.

Use this free Georgia Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Alberta Calgary 6979 Edmonton 6765 Grande Prairie 634 Lethbridge 663 Red Deer 678.

1 bonus in 5 years subject to meeting the conditions of the mortgage. Get Your Estimate. Todays national mortgage rate trends.

The longest term you will be to apply for is up to your age of retirement. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. 021 second mortgage OR home equity loan.

Additional 1 bonus not available for Buy to Let Investment mortgages. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. We built this software specifically to help Kiwis create a financial plan in under an hour.

The first number format refers to the initial period of time that a hybrid mortgage is fixed whereas the second number refers to how frequently the rate can subsequently adjust after the fixed period. The PMI is calculated only if the down payment is less than 20 of the property value and the borrower will have to pay for the mortgage insurance until the balance is less than or equal to 80 of the home value.

Basic Budget Template

Decoomo Trends Home Decor Chambre Princesse Deco Chambre Parents Chambres De Reve

How To Create The Perfectly Organized Fridge And Freezer Refridgerator Organization Refrigerator Organization Fridge Organization

How To Pick Your Retirement Date To Optimize Your Chevron Pension

21 Woolson Rd Lisbon Nh 03585 Realtor Com

Email Opt In Sign Up Sheet Google Search Sign Up Sheets Sign In Sheet Template Sign In Sheet

Picking Up Fall Essentials Fall Essentials Halloween Kids Cute Halloween

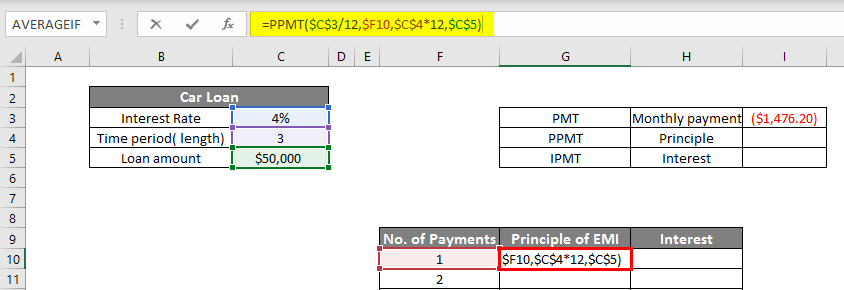

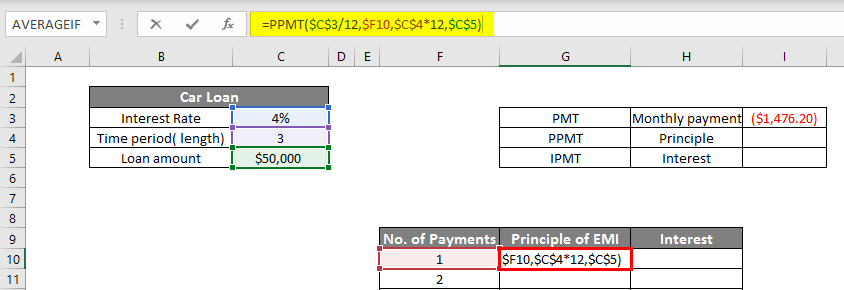

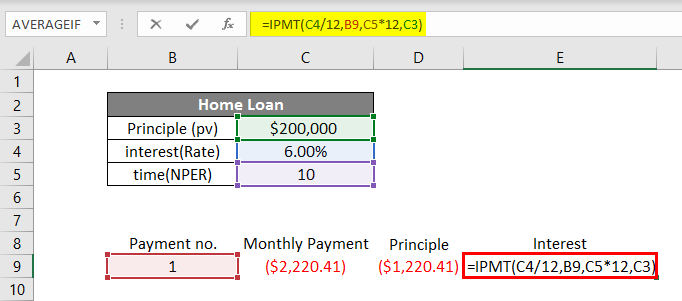

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Sample Free Construction Estimate Template Excel Template Business Construction Work Estimat In 2022 Estimate Template Excel Templates Business Schedule Template

Term Life Insurance What You Need To Know Before You Buy Here S A Comprehensive Guide To Help You Purchase The Ri Term Life Term Life Insurance Life Insurance

58 Sign Up Sheets Sign Up Sheets Sign In Sheet Template Signup

Pin On Vaping

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Law Firm Flyers 4 Options Law Firm Graphic Design Cards Flyer

Easy Fix For Your Kitchen Remodel Home To Z Tuscan Kitchen Kitchen Remodel Small Small L Shaped Kitchens

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel